On 18th of May when GM India announced

that it is exiting from Indian domestic market by the end of 2017, the very

first thought popped up in my mind as a reaction was “how on the earth Mary

Barra (The CEO of GM) & her team can come up with such a strategy which

shuns you from the one of the biggest & emerging markets called India and

then speak about restructuring of global operations for growth.” My fundamental question is can you explain me

how by giving up in one of the most competitively ‘growing’ market, the company

plans to achieve higher growth? I intend to analyze (from two perspectives) the

decision of GM India to shut down its’ car selling business to Indian customers

in domestic market and focus only on production for export from India.

Part 1. What could be

possible drivers behind the decision of exiting from Indian domestic market?

Part 2. Analyzing the decision under current

conditions whether it looks justified or not?

In this blog I’ll be dealing with part 1. Some of the

possible drivers could be identified as under;

1. Consistent

churning at the top: Constant churning at the top management never augurs

well for the health of the organization and same goes with the case of GM India.

Frequent changes at the top position indicate high level of uncertainty about

the organization. As per this

article, GM India has seen nine CEO in the span of 21 years in India. This

gives average tenure of CEO around 2.5 years. Every new CEO who joins, has

generally tendency to realign organization’s goals and strategies this act if

done too frequently(happened in case of GM India) can keep organizations and

its’ stakeholders in fragile mode. GM India never had chance to see the stable

policies in terms of goals & strategies which can reap the benefits.

2. Extremely poor market share: GM India

has sold around

25,823 cars in 2016-17 resulting into less than 1% market share in India.

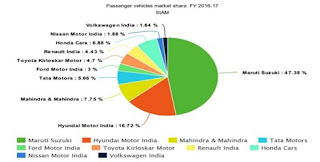

Market share break up as per SIAM is as below;

GM India is nowhere in the above chart which makes a strong

case for shutting down the hugely unsuccessful venture in Indian market. Extremely

small market share brings range of problems for any company but there is

brighter side to this which will be discussed in part-2.

3. Inheritance of financial

troubles of parent company & investors’ pressure: The Company (GM- USA)

which was on verge of bankruptcy during 2008 crisis and bailed out by

Government of USA by purchasing

61% equity stake worth of $50 Bil. has never come out truly from financial troubles since then. Eventually

government sold the stake from GM-USA with decent loss. When parent company

does not have strong financial muscle, one can imagine how competitive the

negotiations can be in the meeting rooms with Parent company when various country heads

demanding higher budgetary allocation for their subsidiary. Indian subsidiary

which has generated very low RoI (Returns on Investment) despite being present

in such emerging market for more than two decades. This must have put future of

GM India on radar of parent company. Lesser financial resource allocation to

under-performing subsidiaries is logical decision, this financial crunch has

also contributed towards decision of exiting Indian domestic market. Investors’

pressure has also generated enough heat as

stock performance of GM has remained subdue. Two years back CEO Mary Barra

has said that India is strategic market and will invest further & now GM

India is exiting from Indian market this shows how much of investor pressure

for better financial performance can lead to harsh and unwanted decisions.

4. Failure to

understand Indian market & cut throat competition: Many experts have

noted and highlighted the failure

of certain automobile MNCs including GM India due to not being able to

adopt the Indian culture and inability

to understand unique requirement of Indian customers. In India many factors

such as price, fuel efficiency, cost of ownership etc. play an important role unlike

some of the developed markets. Interesting to observe that in such a huge Indian market

Maruti Suzuki has near 50% market share while all other big MNC names such as

Toyota, GM, Ford, Volkswagen etc. have managed very small fraction of the

market share. One of the reasons is lack of small car portfolio (Most of the

MNCs never had much of small cars in their portfolio as in other developed

markets big cars are demanded more) which is most successful auto segment in Indian

consumer market. Lack of consistent product and brand strategy has also played

its’ role in denting the position of GM India. It started with Opel brands with

Astra & Corsa, then around 2003 it introduced Chevrolet brand and later it

has moved to Chinese models. Frequent launches and withdrawals of cars have led

to shallow brand loyalty and very challenging new customer acquisition.