From being the company which was dreamed by Dhirubhai for bringing digital

revolution in India to becoming company which is facing strategic debt

restructuring & default

on International debt – Reliance communication Ltd. (formerly Reliance

Infocomm) has come a long way. I have been following for last six months the

twists and turns in the story of Rcom,

which makes me (any many others) wonder, how come Rcom which was considered to

be flagship company of one of the biggest business houses in India with

supposedly good leadership & strong financial muscle ended up in such a bad

mess! Let’s dig deeper & investigate how Rcom has reached this stage;

This blog is divided into two parts: 1) Journey of Rcom :

from Zenith to Nadir 2) Handling of Rcom’s bankruptcy & Strategic debt

restructuring(SDR)

1. Journey of

Rcom : from Zenith to Nadir

I. Problem of telecom

sector, capex requirement & weird govt. auction structure: Telecom

sector has always been capital expenditure heavy. Any company in telecom sector

is required to have strong financial muscle & ability to keep on raising

additional capital (Equity or debt) to fund constantly growing network/towers

expansion, bidding of auctions of spectrum and upgradation of changing

technology. The sector which has grown 20

times in terms of subscribers over last ten years, has also seen rapid

increase in no. of competitors. I believe the biggest threat the telecom sector

has faced is the macro issues such as inconsistent telecom policy, extremely

high cost of acquiring spectrum, impact of 2G scam etc. As

per Sanjay kapoor(industry expert) , COAI

and other

players we have probably highest spectrum cost in the world & lowest

prices for customer, this leads to the very unsustainable business model.

Extremely high reserve price for spectrum auction is making entire industry

debt-laden. If I try to fit Porter’s five forces model for telecom industry at

cursory level after factoring recent years’ macro level changes it may look

like as below;

II.What numbers say:

As

per this article, Industry‘s debt level has risen 6 times in last 8 years,

currently total debt for the industry is around 4.5 trillion (INR). Rcom’s interest service coverage ratio has gone

negative. In last 10 years if we see financials of Rcom the total debt has

doubled in which long term debt has risen by around 46% and short term debt has

gone up by whopping 158%, the total revenue has decreased by 26%. While

EBITDA,PAT and share price has gone down by 90%, 174% (current PAT is negative)

and 98% respectively. Simple observation from the below table can be made that,

on debt front actually Rcom is not the most leveraged firm. Airtel & Idea

are far ahead in having more debt but real blow to Rcom’s survival has come

from Revenue, EBITDA & PAT front. Airtel & Idea has done quite a good

in terms of revenue generation & EBITDA growth which is very important for

any firm to cover at least variable cost.

Airtel

|

Idea

|

Rcom

|

|

Total debt

|

447%

|

1011%

|

96%

|

Total revenue

|

247%

|

707%

|

-26%

|

EBITDA

|

28%

|

872%

|

-90%

|

PAT

|

-346%

|

-269%

|

-174%

|

Share price

|

-0.40

|

-32%

|

-98%

|

Data Source: Money control- last 10 year % change standalone

|

|||

Many companies including Rcom go for short term debt more

than long term for various reasons (either by force or by willingness). But as

short term debt has lower maturity if company has improper liquidity mgt. which

may lead to failure of payment or delay in payment, it rings the bell

immediately. Again habit of borrowing more to repay previous borrowed capital

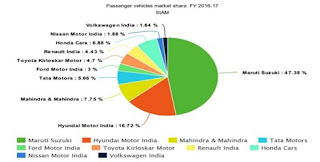

has always brought death spell. If we look at the company-wise market share in

the figure below we realize that Jio is sending tremors to big players and it

is already killing small Players like Telenor (just barely surviving), Tata (

already gone), Aircel ( fighting to retain), Rcom ( many services are

closed).

III. Self-inflicted

wounds of Rcom: Back in 2002 under unified brand of RIL in the age when

incoming was not free, Rcom is credited with introduction of incoming free

services (called monsoon hungama plan). When in 2006 Reliance

got split, Rcom came under the leadership of Anil Ambani, during that time

the key strategy adopted by Rcom was to flood the market with dirt cheap CDMA

phones to capture the higher market share. It worked initially but this has

contributed to the ever increasing mountain of debt for Rcom. To hold on to the

market share gained, Rcom introduced predatory pricing by making call rates at

50 paisa per minute in 2009. In 2014 Rcom

realized & divided its’ CDMA & GSM business in order to safeguard

its’ growing business which was GSM and planning to sell CDMA to reduce some

debt. As

per this data, Rcom’s market share which was 13.71% in Jan-2013 has halved

to 6.51% in Aug-2017. In this same time period Rcom’s cost has gone up and so

as borrowing (to take care of rising cost if revenue source is not sufficient

firm has to raise extra capital) while revenue, EBITDA, PAT & share price

has significantly come down. Rcom’s strategy of extreme low pricing &

selling CDMA phone at very low price has contributed along with high auction

prices for spectrum to its’ mountain of debt, this strategy gave Rcom initially

big chunk of subscriber base but Its’ failure to retain this subscribers &

eventually convert this low-revenue generating subscribers to high revenue

generating subscribers has led to big down fall. At the end I would say, the

strategy of predatory pricing (extreme low pricing) to acquire bigger market

share & generate higher revenue generally leads to unsustainable business

model (I can recall Flipkart, Snapdeal, Amazon’s e-platform biz to name a few).

IV.Last nail to the

coffin by Reliance Jio: Entry of Reliance Jio has made sure that weaker

& small players are out of the business and bigger players bleed

significantly. Since Reliance jio’s entry in 2015, Rcom is going through the

worst time period. But I disagree with Anil

Ambani’s statement that Reliance Jio has to be blamed for what has happened

to the company & sector at large. Rcom was already on sort of ventilator

and Jio’s entry expedited the process of ‘pulling the plug’. Rcom had huge debt

pile before Jio came & Jio is repeated the same strategy of low price which

Rcom relied upon in its initial years. Similarly Telecom sector was already in

big debt burden due to high spectrum prices & ever increasing infra

requirement but it is also true that Jio has disrupted the telecom sector by

impacting revenue flow of major players which has added one more issue to

tackle with in the long list of issues pending in telecom sector need to be

addressed.

I believe Government

has also played its part in making telecom sector very

turbulent & risky

due to high auctions prices for spectrum along with complexity &

uncertainly of regulation of telecom. Government should

certainly look at more ‘reasonable revenue generating and long term

sustainable auction model’ instead of ‘extremely high revenue generating short

term unsustainable auction model’. Several factors as describe above is making many

banks nervous as their huge lending to telecom companies can turn into NPA.

It is high time for telecom ministry to intervene!